London

CONNECTING LIFE SCIENCE & HEALTHCARE EXECUTIVES WITH CAPITAL & PARTNERS

Part of Europe's biggest dedicated healthcare investment week

"The most comprehensive yet efficient forum in one day!"

- Melior Capital Management

What is Inv€$tival Showcase?

Inv€$tival Showcase is your Ultimate Biotech, Healthtech and Medtech Networking & Pitching Event in London.

With 7 incredible presenting stages for startup, growth stage and publicly listed Biotech, Healthtech, Medtech, TechBio, Digital Health and Deeptech companies.

The LSX Investival Showcase continues its exclusive partnership with global investment bank Jefferies, serving as the kick off to Jefferies week, leading into the Jefferies London Healthcare Conference.

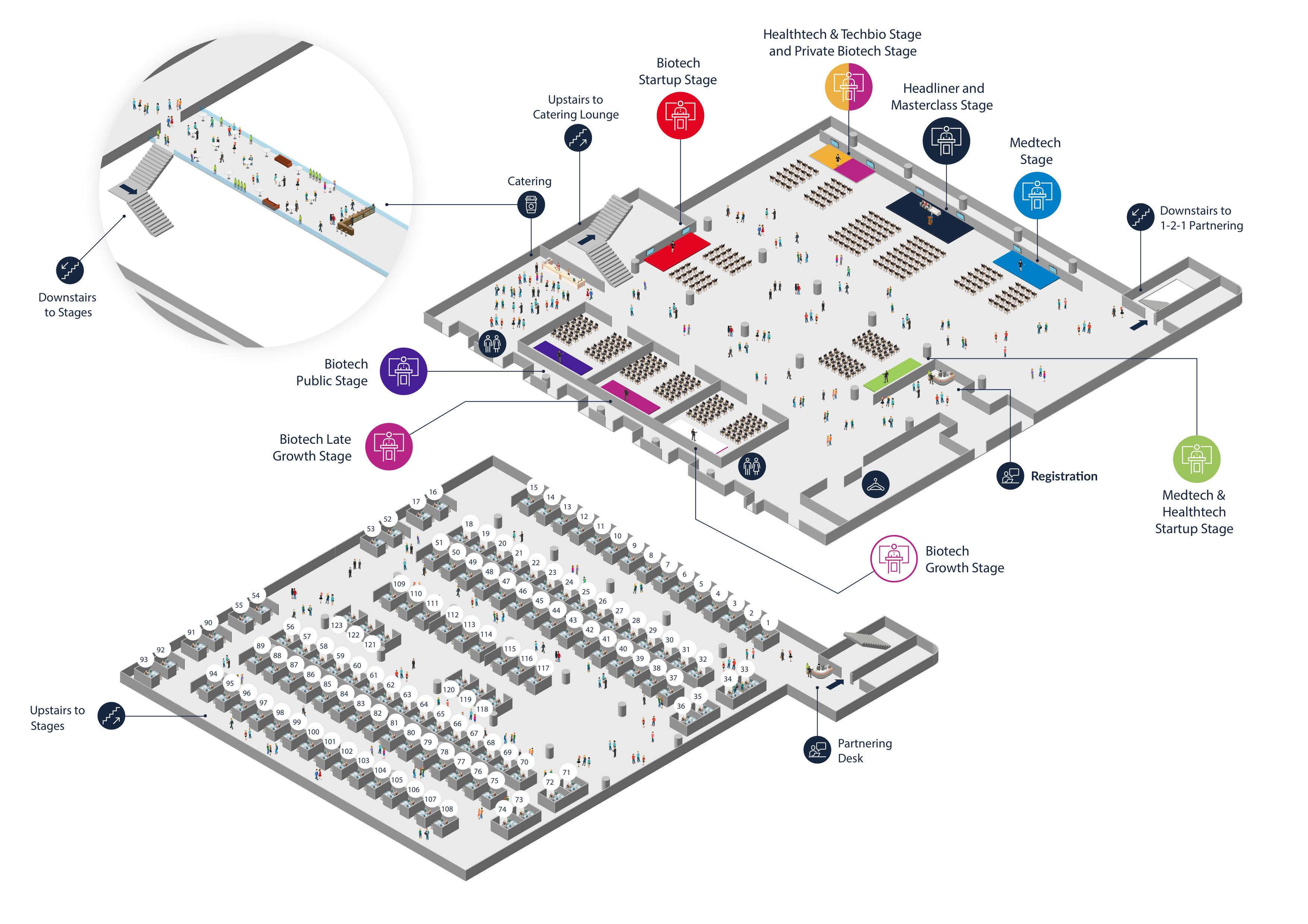

Floor Plan

In 2023 the content was all on one floor creating a festival feel with all the stages and informal networking. Formal 1-2-1 partnering took place on its own floor to create the right environment for discussions.

Inv€$tival Showcase ... The Numbers

1000+

Attendees

350+

Investors & Strategics

150+

Showcases

2000+

1-2-1 Partnering meetings

1:1

Partnering

8

Content Stages

200+

Speakers

3

Masterclasses

We do not share any data without consent

Outside vendors who contact you to sell attendee lists are operating independently and without approval of the event organisers.